estate tax changes build back better

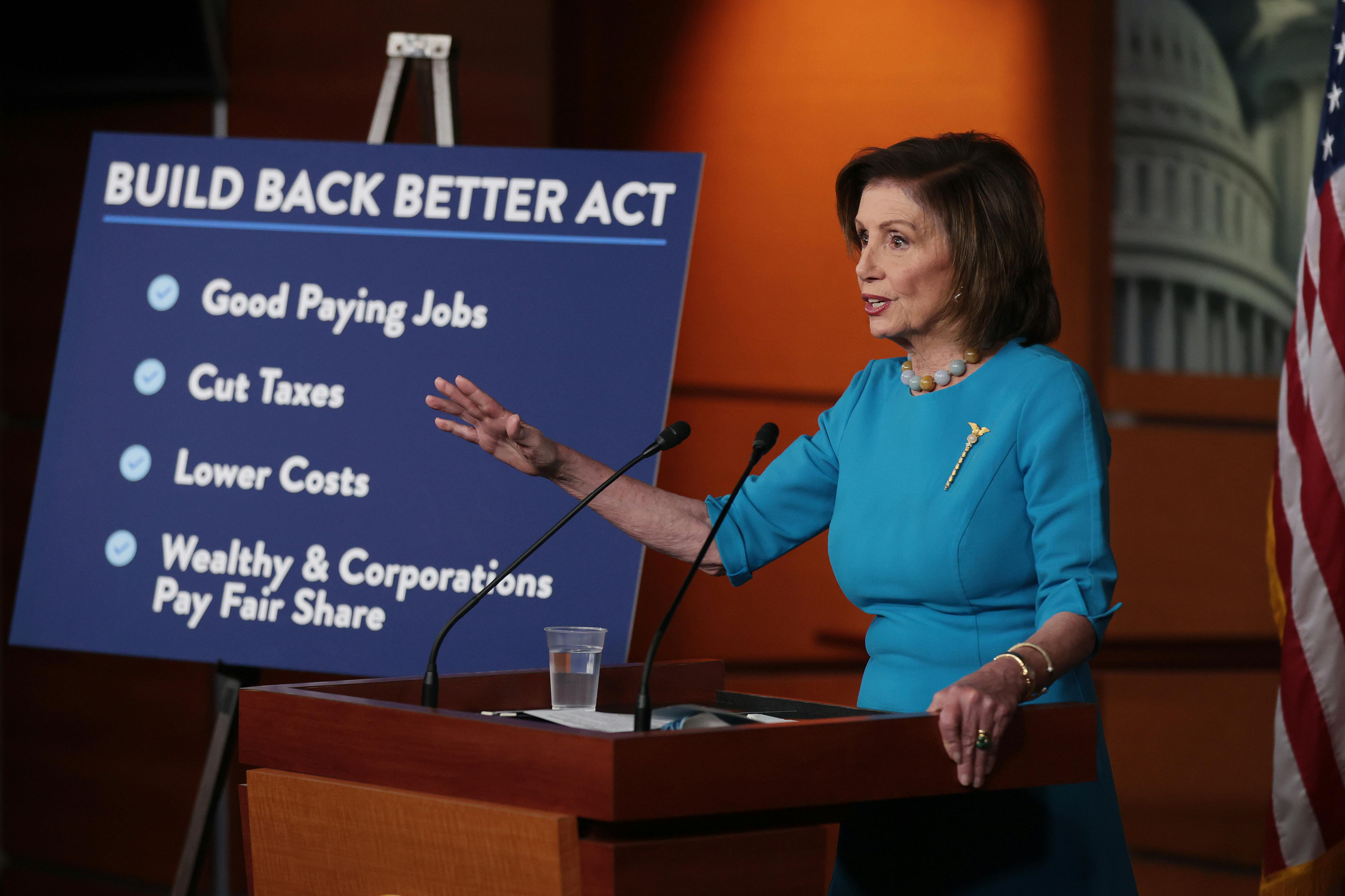

In late October the House Rules Committee released a revised version of the proposed Build Back Better Act Reconciliation Bill. At the time lawmakers were negotiating over the administrations now-defunct Build Back Better bill and both the White House.

End Your Tax Nightmare Now.

. The proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. On September 13 2021 the Chairman of the House Ways and Means Committee released the proposed Build Back Better Act the Proposed Act. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov.

President Bidens Build Back Better Act has made a significant first step towards passage as the House Ways and Means Committee approves the bills tax provisionsAs the draft now stands the legislative proposal may restrict the ability of higher net. On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act The segments of the proposed bill discussed below highlight important changes to the way trusts estates and individuals could be taxed. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation.

Pittsburgh Estate Planning Attorneys. Our tax expert weighs in. The Build Back Better Act includes a 5 surtax imposed on MAGI that have in excess of 10 million as well as an additional 3 surtax if the MAGI exceed 25 million.

It is important to remember that there may be further changes to the Act in the coming days. 3 version introduced an increase to the cap with a slightly higher increase in the Nov. Another gifting technique subject to BBBA proposed changes is the elimination of specific valuation discounts.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. These proposals are currently under consideration by the U. Under current law the existing 10 million.

Revised Build Back Better Bill Excludes Major Estate Tax Proposals. The House Ways and Means Committee advanced its portion of the Proposed Act on September 15 2021 which addresses numerous fiscal issues including many tax increases. The proposal reduces the exemption from estate and gift taxes from 10000000.

The current version of the. The Framework contained none of the gift tax estate tax or trust tax provisions that had been proposed by the House Ways and Means Committee in September as part of Congress 35. Estate and gift tax exemption.

Lowering the gift and estate tax exemptions seems a lock. The estate planning community got some very good news on October 28 2021 when the Biden administration released its Framework for the Build Back Better Act. The CBO estimates the bill will cost almost 17 trillion and add 367 billion to the federal deficit over 10 years.

28 2021 President Joe Biden announced a framework for changes to the US. Build Back Better Act and Estate Planning Changes. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives. However it is important to note that. On September 13 the House Ways and Means Committee released its plan to pay for the 35 trillion Build Back Better Act with a variety of changes across the tax code but the.

Understanding Other Proposed Changes Under the Build Back Better Act. Tax Changes for Estates and Trusts in the Build Back Better. The upshot is to avoid these new grantor trust tax rules create and fully fund your grantor trust by the end of 2021.

Build Back Better Act and Estate Planning Changes. Build Back Better Estate Tax Law Changes. Most of the major proposals that would create substantial changes in the estate planning arena were not included.

The provisions effective date is January 1 2022 and the expectation is the law will. As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1 2022. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022.

Instead it contains three primary changes affecting estate and gift taxes. This Alert will provide a brief. 9 hours agoThe White House had contemplated a carbon tax in the fall of 2021.

Adding in 207 billion of nonscored revenue that is estimated to result from increased tax enforcement in the bill the net total increase to the deficit would be 160 billion. In its then-current form the legislation would have had drastic impacts on transfer taxes grantor trust rules and income taxes. The bill contains a wide variety of tax provisions.

Economic Effects of the Updated House Build Back Better Act For purposes of estimating the bills impact on federal budget deficits interest payments and resulting changes in GNP we have estimated about 213 trillion of net outlays over the period 2022-2031 inclusive of scored tax credits. Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the estate tax laws. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law.

Gift and Estate Taxes Proposed Under the Build Back Better Act. Ad 5 Best Tax Relief Companies of 2022.

What S In Joe Biden S Plan For Child Care And Elder Care Npr

Racial Justice Organizations Ask Congress To Reinstate Child Tax Credit

Build Back Better Tax Legislation Deloitte Us

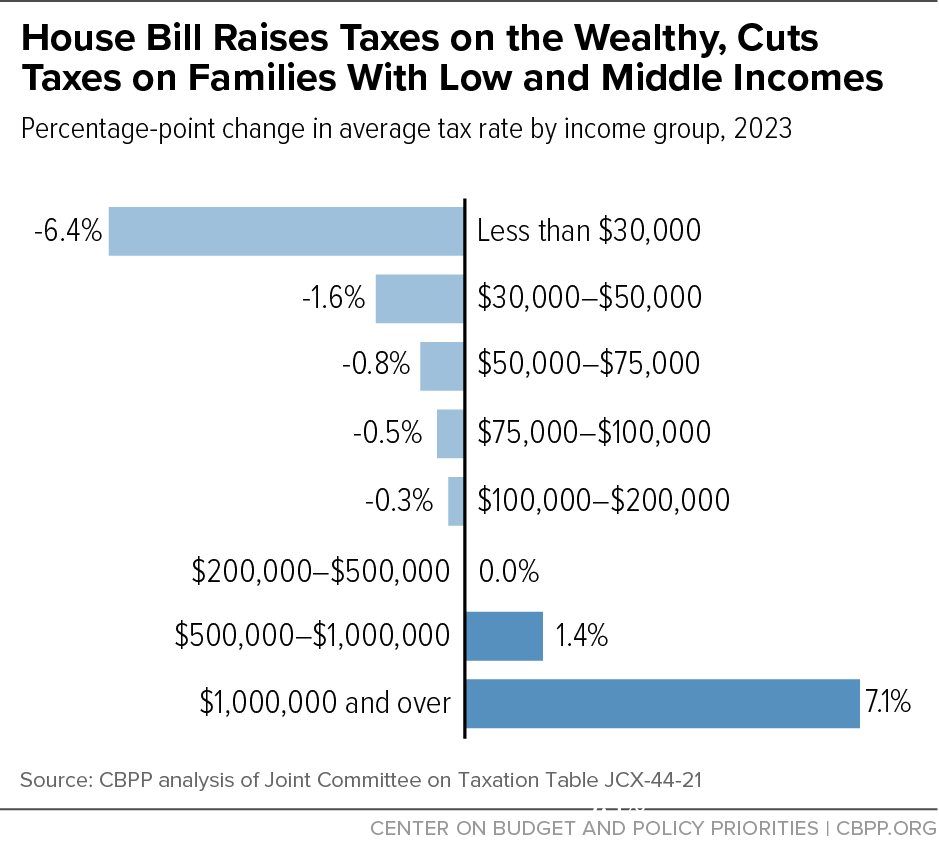

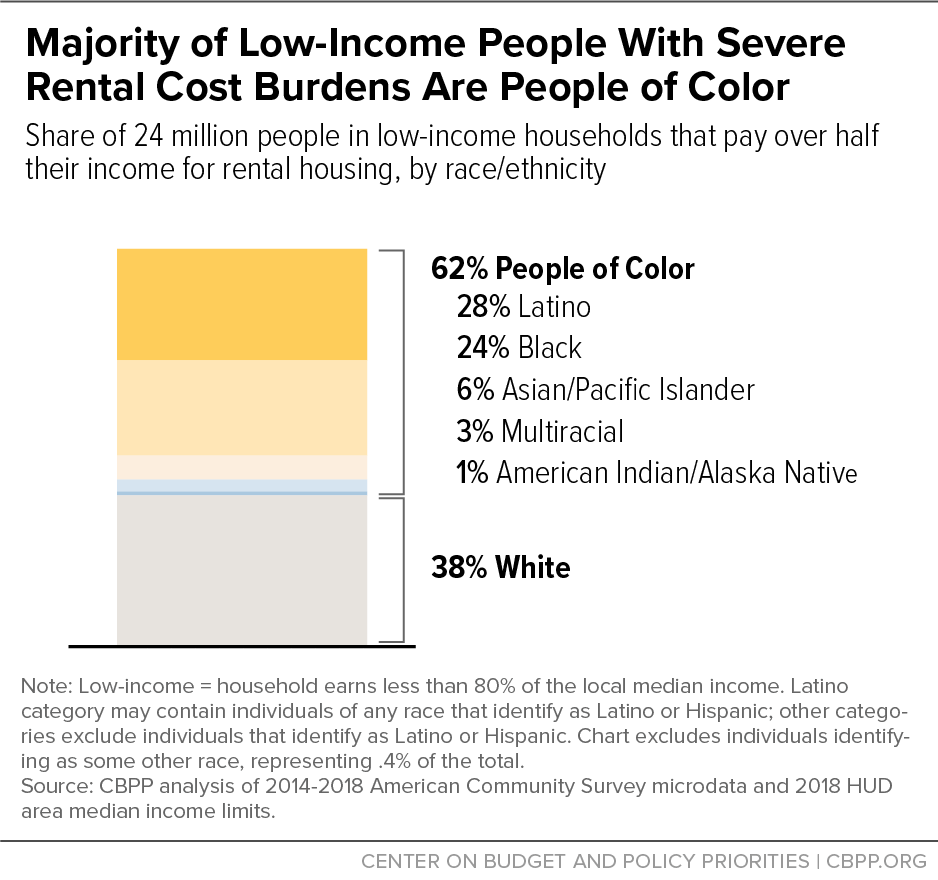

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Build Back Better Tax Legislation Deloitte Us

Whatever This Is It Won T Be Build Back Better

The Build Back Better Act Transformative Investments In America S Families Economy House Budget Committee Democrats

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

Biden Pledges Executive Action After Joe Manchin Scuppers Climate Agenda Joe Manchin The Guardian

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

House Democrats Deliver The Build Back Better Act Now Comes The Hard Part The New Republic

Biden Build Back Better Bill Passes Procedural Vote In House

Joe Manchin Agrees To Climate And Tax Deal What You Need To Know

Ev Tax Credits In Biden S Build Back Better Act Will Help Sell More Cars Than New Chargers

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Why This Tax Provision Puts Democrats In A Tough Place Time

Joe Biden Thinks Congress Can Pass Part Of Build Back Better Act